Vehicle leasing platforms are revolutionizing how individuals and businesses acquire transportation. These platforms offer a wide array of leasing options, simplifying the process and providing a convenient one-stop shop for everything from car selection to contract negotiation. This detailed exploration delves into the intricacies of these platforms, covering everything from market trends to user experience and the critical technological infrastructure underpinning their success.

The guide will cover key aspects of vehicle leasing platforms, including different types of leasing options, popular platforms, market trends, and the user experience. It will also delve into the business models, technology, legal considerations, customer support, and marketing strategies employed by these platforms. Furthermore, the impact on sustainability and future innovations will be discussed.

Introduction to Vehicle Leasing Platforms

Vehicle leasing platforms are online marketplaces that connect individuals and businesses seeking to lease vehicles with providers offering various leasing options. These platforms streamline the entire process, from browsing available vehicles to signing leasing agreements. They often offer comprehensive tools for comparison and selection, making the process more efficient and transparent.These platforms have become increasingly popular due to their convenience and ease of access.

They typically offer a wide selection of vehicles, catering to diverse needs and budgets. The accessibility and transparency of the process have significantly impacted the automotive leasing industry.

Key Features and Functionalities

Vehicle leasing platforms typically feature comprehensive listings of vehicles available for lease, categorized by make, model, year, and other relevant criteria. Detailed specifications and images of the vehicles are often displayed. Users can filter and sort these listings based on various parameters, enabling a targeted search. Key functionalities also include secure online payment options, lease agreement generation, and document management.

These platforms facilitate the entire process from initial search to final agreement, aiming to provide a smooth and streamlined experience.

Different Types of Vehicle Leasing Options

Vehicle leasing platforms cater to diverse needs with various leasing options. These options include short-term leases, suitable for temporary needs, and long-term leases, ideal for those seeking extended use. Business leases often include tailored options like maintenance packages and mileage allowances. Specific lease terms, such as options to purchase at the end of the lease, are also frequently available.

Platforms typically showcase the different lease types clearly, allowing users to compare and choose the most suitable option.

Examples of Popular Vehicle Leasing Platforms

Several prominent vehicle leasing platforms have emerged, catering to diverse market segments. Examples include LeasePlan, Enterprise, and various independent platforms focusing on specific vehicle types or regions. These platforms often provide user-friendly interfaces and comprehensive services to ease the leasing process.

Comparison of Key Features

| Platform Name | Leasing Types | Pricing Model | Customer Support |

|---|---|---|---|

| LeasePlan | Short-term, long-term, business leases | Competitive pricing based on vehicle and lease terms | Dedicated customer service representatives, online FAQs, and chat support |

| Enterprise | Short-term, long-term, fleet management solutions | Competitive pricing; often bundles packages for fleets | Extensive online resources, telephone support, and local service centers |

| Example Platform A | Short-term, long-term | Transparent pricing; detailed breakdowns | Online chat, email support, and phone support |

This table illustrates a comparative analysis of key features across different vehicle leasing platforms. The platforms vary in their offerings and services, catering to specific needs and preferences. Factors such as lease types, pricing models, and customer support should be carefully considered when selecting a platform.

Market Overview and Trends

The vehicle leasing market is experiencing significant growth, driven by evolving consumer preferences and technological advancements. This dynamic environment presents both opportunities and challenges for vehicle leasing platforms. Understanding the key market segments, growth trends, and competitive landscape is crucial for success in this sector.

Key Market Segments

Vehicle leasing platforms cater to a diverse range of needs. Businesses, individuals, and even government entities are frequent users of leasing services. Businesses often lease vehicles for fleet management, reducing capital expenditures and improving operational efficiency. Individuals lease for a variety of reasons, including reduced upfront costs, access to newer models, and potential tax advantages. Government agencies utilize leasing for various purposes, including transportation of personnel and goods.

These diverse segments represent a substantial potential market for vehicle leasing platforms.

Growth Trends and Future Projections

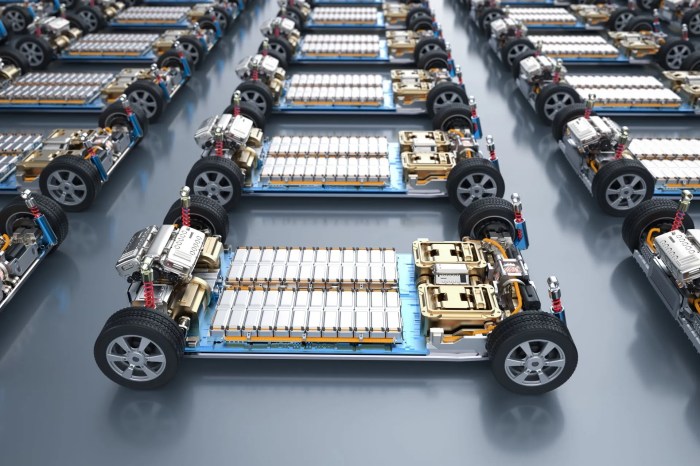

The vehicle leasing market demonstrates consistent growth. Increased adoption of electric vehicles (EVs) and the rise of shared mobility services are key factors driving this growth. As consumer demand for EVs rises, leasing platforms are adapting to offer a wider range of EV models and services. This trend is likely to continue as more sustainable transportation options become available.

Future projections anticipate substantial growth in the leasing sector, especially in emerging markets. The rise of subscription services and flexible leasing options also contributes to market expansion.

Competitive Landscape and Major Players

The vehicle leasing industry is highly competitive. Established players like Enterprise Rent-a-Car and Hertz, along with numerous specialized leasing companies, dominate the market. However, the entry of new, tech-savvy companies focused on digital platforms and innovative leasing models is creating a dynamic competitive landscape. This increasing competition necessitates a focus on customer experience, streamlined processes, and innovative pricing strategies.

Impact of Technological Advancements

Technological advancements are reshaping the vehicle leasing sector. Digital platforms allow for streamlined transactions, improved customer service, and data-driven decision-making. Real-time tracking, online booking, and mobile apps are transforming how leasing is conducted. Artificial intelligence (AI) and machine learning (ML) can be used to analyze customer data, optimize pricing, and predict maintenance needs. These technologies are critical for improving efficiency, reducing costs, and enhancing the overall customer experience.

Market Trends and Future Projections

| Trend | Description | Impact on Platforms | Projected Growth |

|---|---|---|---|

| Increased Adoption of EVs | Growing consumer demand for electric vehicles. | Platforms need to offer a wider range of EV models and charging infrastructure solutions. | High (projected 15-20% CAGR) |

| Rise of Shared Mobility Services | Growing popularity of car-sharing and ride-sharing platforms. | Potential for partnerships and integration with shared mobility services. | Moderate (projected 10-15% CAGR) |

| Digitalization of Processes | Increased use of online platforms and mobile apps for leasing transactions. | Enhanced customer experience, improved efficiency, and data-driven decision-making. | High (projected 20-25% CAGR) |

| Focus on Sustainability | Growing environmental awareness and demand for sustainable transportation options. | Platforms need to highlight eco-friendly leasing options and contribute to reducing carbon emissions. | High (projected 15-20% CAGR) |

User Experience and Customer Journey

A strong user experience (UX) is critical for vehicle leasing platforms to attract and retain customers. A seamless and intuitive journey fosters trust and encourages repeat business. This section explores the typical user journey, identifies pain points, and suggests improvements for enhancing usability.

Typical User Journey

The typical user journey on a vehicle leasing platform begins with browsing available vehicles. Users typically filter by desired features, price range, and location. Following selection, a thorough review of the terms and conditions is crucial before proceeding with the lease application. This often includes providing personal information, credit history details, and confirming the chosen vehicle’s specifications.

Upon approval, users finalize the lease agreement, receive documentation, and schedule vehicle pickup.

Key Pain Points and Areas for Improvement

Several pain points can hinder the user experience on vehicle leasing platforms. Complex application processes, unclear pricing structures, and lengthy approval times often frustrate potential customers. Inaccurate or inconsistent information, particularly regarding vehicle details, can lead to confusion and distrust. Limited communication throughout the process, especially during the approval phase, creates uncertainty and potentially delays. Improved communication channels and proactive updates can significantly mitigate these issues.

User Interface Design Enhancements

User interfaces (UIs) play a pivotal role in enhancing usability. Clear and concise layouts, intuitive navigation, and visually appealing designs can significantly improve the overall experience. The use of interactive elements, such as vehicle configurators and detailed specifications, can provide a richer and more engaging experience. Visual representations of the lease terms and associated costs can aid users in understanding the financial implications.

Employing a conversational AI or chatbots can expedite inquiries and provide real-time support. This can significantly streamline the application process and reduce the need for extensive back-and-forth communication.

Successful UI Designs in Automotive Leasing

Several successful UI designs in the automotive leasing industry have focused on intuitive navigation and clear information presentation. For example, some platforms have integrated detailed vehicle specifications into the browsing experience, enabling users to quickly assess features and options. Others have simplified the lease application form, reducing the number of required fields and making the process more user-friendly.

Furthermore, well-designed dashboards and progress trackers allow users to monitor the status of their application in real time. The integration of real-time pricing updates and interactive tools to visualize lease costs is another successful approach.

User Experience Stages and Key Actions

| Stage | User Action | Platform Response | User Feedback |

|---|---|---|---|

| Vehicle Browsing | Filters vehicles by criteria (e.g., make, model, price). | Displays matching vehicles with clear details. | Positive if easy to navigate, negative if unclear filters. |

| Application Initiation | Completes the application form. | Provides real-time validation and feedback on input. | Positive if intuitive, negative if overly complex or error-prone. |

| Approval/Declinature | Awaits application status update. | Provides updates on the application progress. | Positive if timely and transparent, negative if delayed or unclear. |

| Agreement Finalization | Reviews and signs the lease agreement. | Provides secure digital signing and clear document presentation. | Positive if secure and easy-to-understand, negative if complex or insecure. |

Business Models and Revenue Streams

Vehicle leasing platforms leverage diverse business models to cater to various customer needs and market segments. Understanding these models and their associated revenue streams is crucial for assessing platform profitability and competitive positioning. This section delves into the intricacies of these models, highlighting key factors that drive platform success.

Various Business Models

Vehicle leasing platforms employ several business models, each tailored to specific needs. A primary model involves acting as a direct leasing provider, acquiring vehicles and leasing them out to customers. Another common model involves acting as a platform connecting vehicle owners with potential lessees, often incorporating features for secure transactions and management of contracts. Furthermore, platforms may partner with manufacturers or dealerships, facilitating leasing options to their clientele.

These models range from full-service leasing to more hands-off approaches, reflecting the spectrum of customer needs and preferences.

Vehicle leasing platforms are becoming increasingly popular, offering a convenient alternative to traditional car ownership. Imagine the possibilities if these platforms expanded to include futuristic transportation like flying cars , opening up a whole new world of possibilities for urban mobility. Ultimately, these platforms will need to adapt to the evolving landscape of personal transportation, whether it’s on the ground or in the air.

Revenue Streams

Vehicle leasing platforms generate revenue through multiple streams. The most prominent is leasing fees, charged based on the vehicle, lease term, and other factors. Additionally, platforms might generate revenue through ancillary services such as maintenance packages, insurance, and roadside assistance, offered as add-ons to the core leasing agreement. Finally, some platforms earn commissions from dealerships or manufacturers for facilitating leases.

Pricing Models

Pricing models vary across platforms, often reflecting their specific business model. Some platforms employ a fixed-price structure for leasing, transparently displaying the total cost. Other models include variable pricing, influenced by factors like market demand, vehicle availability, and the lease duration. Some platforms might offer flexible payment plans, allowing lessees to manage their financial obligations more effectively.

Factors Influencing Platform Profitability

Profitability for vehicle leasing platforms is significantly influenced by several factors. Effective cost management, encompassing vehicle acquisition costs, administrative expenses, and operational overhead, plays a pivotal role. Strong negotiation skills with manufacturers and suppliers to secure favorable vehicle pricing are essential. Furthermore, platform efficiency, including streamlined processes and technologies, contribute to improved profitability.

Comparison of Business Models and Revenue Streams, Vehicle leasing platforms

| Model | Revenue Source | Target Audience | Profitability |

|---|---|---|---|

| Direct Leasing Provider | Lease fees, ancillary services | Businesses and individuals seeking long-term leasing solutions | Dependent on efficient cost management and favorable lease terms. |

| Platform Connecting Owners and Lessees | Transaction fees, commissions | Vehicle owners looking for buyers, lessees seeking vehicles | Dependent on platform traffic and successful transactions. |

| Partnering with Manufacturers/Dealerships | Commissions, volume-based discounts | Individuals and businesses looking for leasing options through established networks. | Profitability hinges on strong partnerships and high volume transactions. |

Technology and Infrastructure

Vehicle leasing platforms rely heavily on robust technology to manage complex transactions, user interactions, and vast amounts of data. A sophisticated infrastructure is crucial for handling high volumes of requests, ensuring secure data storage, and enabling seamless operations. The platform’s efficiency and user experience directly correlate with the quality and scalability of its technological underpinnings.The technology stack powering these platforms is diverse, encompassing various software and hardware components.

From user interfaces and backend systems to data analytics tools and security protocols, each element plays a vital role in the platform’s functionality. This complex interplay ensures the smooth operation and user-friendliness of the platform.

Technology Stack Components

The technology stack employed by vehicle leasing platforms typically includes a web application or mobile app, a database system for managing vehicle listings, customer profiles, and transactions, and a payment gateway for secure financial transactions. Modern platforms frequently leverage cloud computing for scalability and cost-effectiveness.

Infrastructure Requirements

A robust infrastructure is paramount to support the volume and complexity of operations. This infrastructure includes high-performance servers to handle transaction processing, secure storage for sensitive data, and high-bandwidth networks for efficient data transmission. Data centers with redundant systems are often deployed to ensure continuous operation. The ability to scale the infrastructure is crucial for adapting to fluctuating demand and accommodating future growth.

Security Measures

Data security is a top priority for vehicle leasing platforms. A multi-layered security approach is implemented, encompassing encryption of sensitive data both in transit and at rest. Regular security audits and penetration testing are performed to identify and mitigate vulnerabilities. Strong access controls and user authentication procedures are in place to protect against unauthorized access. Compliance with industry regulations, such as GDPR, is also essential.

Data Analytics Role

Data analytics plays a significant role in improving platform performance. By analyzing user behavior, transaction patterns, and market trends, leasing platforms can optimize pricing strategies, personalize user experiences, and identify areas for improvement. Real-time data dashboards provide insights into key performance indicators (KPIs), allowing for proactive adjustments and strategic decision-making. Machine learning algorithms can predict demand and optimize inventory management.

Technology Overview

| Technology | Function | Security Considerations | Scalability |

|---|---|---|---|

| Cloud Computing Platforms (e.g., AWS, Azure) | Hosting applications and data, enabling scalability and flexibility | Robust security protocols, access controls, and data encryption are crucial. | Highly scalable; resources can be dynamically allocated to meet demand. |

| Relational Database Management Systems (e.g., MySQL, PostgreSQL) | Storing and managing vehicle data, customer information, and transaction history. | Secure access controls and data encryption are essential. | Scalable through database sharding and replication. |

| API Integration (e.g., payment gateways, authentication providers) | Connecting with external services for secure transactions and user authentication. | Thorough validation of API providers’ security practices. | APIs can be scaled by increasing the number of requests that can be processed simultaneously. |

| Payment Gateways (e.g., Stripe, PayPal) | Processing secure online payments | Compliance with PCI DSS and other security standards is mandatory. | Scalable to handle fluctuating transaction volumes. |

| Machine Learning/AI | Predictive modeling for inventory management, pricing strategies, and fraud detection. | Data privacy and security of models need to be considered. | Scalable through distributed computing frameworks. |

Legal and Regulatory Aspects: Vehicle Leasing Platforms

Navigating the legal landscape is crucial for vehicle leasing platforms. Compliance with diverse regulations across different regions is essential to maintain operational integrity and avoid potential legal issues. These regulations impact everything from contract terms to data privacy and financial reporting.Vehicle leasing platforms must understand and adapt to varying legal frameworks to ensure seamless operations. This involves comprehending the nuances of each region’s regulations, tailoring their services accordingly, and ensuring compliance in all aspects of their business.

Legal Frameworks Governing Vehicle Leasing

Different regions have distinct legal frameworks for vehicle leasing, impacting the structure and operation of leasing platforms. These frameworks often cover areas like contract formation, consumer rights, data protection, and financial reporting. Understanding these differences is paramount for platforms aiming for global expansion.

Implications for Vehicle Leasing Platforms

The implications of regional regulations for vehicle leasing platforms are significant. They affect pricing strategies, contract terms, and compliance procedures. For instance, stringent consumer protection laws in certain regions might necessitate more detailed and transparent contract language. These regulations also influence the platform’s risk management strategies, particularly in terms of customer disputes and potential liabilities.

Compliance Requirements for Platforms

Vehicle leasing platforms must meet specific compliance requirements to operate legally in each region. These include adhering to local laws on consumer protection, data privacy (like GDPR), and financial reporting. They must also ensure contracts are legally sound and comply with any industry-specific regulations. These compliance requirements vary significantly by jurisdiction and necessitate a robust legal framework for the platform to follow.

Regulatory Challenges Faced by Platforms

Vehicle leasing platforms face various regulatory challenges, including differing interpretations of laws across jurisdictions. For example, differing standards for disclosure requirements can create complexities in tailoring contracts to multiple markets. Varying consumer protection laws, tax regulations, and environmental standards further add to the challenge.

Key Legal and Regulatory Considerations

| Region | Key Law | Platform Impact | Compliance |

|---|---|---|---|

| European Union | GDPR | Strict data protection requirements, impacting user data handling and transparency. | Implementing robust data privacy policies, obtaining consent for data usage, and adhering to data breach notification procedures. |

| United States | State and Federal Consumer Protection Laws | Diverse regulations on leasing contracts, consumer rights, and disclosure requirements. | Thorough review of contracts, clear and transparent communication, and compliance with state-specific regulations. |

| China | Consumer Protection Law | Emphasis on consumer rights and dispute resolution, potentially impacting dispute resolution mechanisms. | Understanding Chinese consumer expectations and regulations, implementing procedures for dispute resolution, and potential need for local legal representation. |

| India | Motor Vehicles Act and other consumer laws | Specific rules on vehicle registration, insurance, and leasing contracts. | Compliance with registration and insurance requirements, understanding local tax laws, and ensuring transparency in leasing agreements. |

Customer Support and Service

Vehicle leasing platforms rely heavily on effective customer support to foster trust and loyalty. A robust support system directly impacts user satisfaction, repeat business, and the overall platform reputation. Addressing customer needs promptly and efficiently is critical for success in this competitive market.

Different Support Channels Offered

Vehicle leasing platforms leverage various channels to connect with customers. These channels cater to diverse preferences and ensure accessibility across different time zones and devices.

- Customer support platforms (e.g., live chat, email): These are convenient, real-time communication options that provide immediate assistance. Live chat, in particular, allows for quick resolutions to common issues, such as account access or payment queries.

- Phone support: Phone support offers personalized interaction, enabling deeper troubleshooting and problem-solving for more complex situations.

- Knowledge bases and FAQs: These resources act as self-service tools. Comprehensive knowledge bases equip customers with readily available information, reducing the need for direct support interventions and resolving common issues independently.

- Social media channels (e.g., Twitter, Facebook): Social media platforms allow for broader reach and prompt engagement with customers on a public forum.

Importance of Customer Support in User Retention

High-quality customer support is a cornerstone of user retention. Prompt and effective resolutions to customer issues demonstrate a commitment to customer satisfaction, fostering loyalty and encouraging repeat business. Happy customers are more likely to recommend the platform to others.

Key Metrics for Evaluating Customer Support Performance

Several key metrics assess the effectiveness of customer support. These metrics help track progress and identify areas needing improvement.

- Response time: The time taken to acknowledge and respond to a customer query or request. Fast response times are crucial for maintaining customer satisfaction.

- Customer satisfaction (CSAT): A metric reflecting the overall satisfaction of customers with the support they receive. High CSAT scores indicate positive experiences.

- Resolution rate: The percentage of customer issues resolved during the initial interaction. A high resolution rate demonstrates the effectiveness of the support team.

- First contact resolution (FCR): The percentage of customer issues resolved during the first interaction. A high FCR rate indicates efficiency and reduced back-and-forth.

Examples of Exceptional Customer Support Strategies

Exceptional customer support often involves proactive communication, personalization, and a commitment to finding lasting solutions.

- Proactive outreach: Reaching out to customers with relevant information or support before they initiate a query demonstrates a proactive approach. For example, reminding customers of upcoming lease renewals or notifying them of maintenance schedules can prevent potential issues.

- Personalized communication: Tailoring support to individual customer needs and preferences enhances the customer experience. Using customer names and acknowledging past interactions can create a more personalized and effective experience.

- Empowering support agents: Providing agents with comprehensive training and resources enables them to handle complex situations effectively and efficiently. Training on product knowledge, policy understanding, and conflict resolution skills is crucial.

Support Channels and Response Times

A well-structured support system provides clear channels and realistic response times. This table illustrates a potential framework for evaluating support channels.

| Channel | Response Time | Customer Satisfaction | Resolution Rate |

|---|---|---|---|

| Live Chat | Within 1-2 minutes | High (e.g., 90%) | High (e.g., 85%) |

| Within 24 hours | Medium (e.g., 80%) | Medium (e.g., 75%) | |

| Phone | Within 15-30 minutes | High (e.g., 95%) | High (e.g., 90%) |

| Knowledge Base | Instant | Medium (e.g., 75%) | High (e.g., 60%) |

Security and Data Protection

Vehicle leasing platforms handle sensitive user data, including financial information and personal details. Robust security measures are crucial to maintain user trust and prevent potential breaches. Protecting this data is paramount to fostering a safe and reliable platform for both customers and partners.

Importance of Data Security

Data security is vital for vehicle leasing platforms to maintain user trust and prevent financial losses. Compromised data can lead to significant reputational damage, legal issues, and financial penalties. The increasing reliance on digital platforms for vehicle leasing necessitates a proactive approach to safeguarding user information. Protecting sensitive data is not just about preventing breaches; it also involves building user confidence and fostering a positive user experience.

Security Measures for User Data

A multi-layered approach to security is essential for protecting user data. This includes implementing strong encryption protocols for data transmission and storage, employing access controls to restrict data access to authorized personnel, and using multi-factor authentication to verify user identities. Regular security audits and vulnerability assessments are also critical components.

Financial Transaction Security

Securing financial transactions is paramount for maintaining user confidence and preventing fraud. Platforms should employ advanced encryption techniques during transactions, adhere to industry-standard security protocols, and utilize fraud detection systems to identify and mitigate suspicious activity. Transparent and easily accessible transaction history is a valuable tool for both users and platform administrators.

Role of Compliance in Data Protection

Adherence to relevant data protection regulations, such as GDPR, is essential for vehicle leasing platforms. These regulations Artikel specific requirements for data collection, storage, and processing. Compliance ensures legal adherence, minimizes the risk of penalties, and builds trust among users and regulators. This involves meticulous documentation of data handling practices and regular audits to ensure ongoing compliance.

Security Measures and Impact on User Trust

| Measure | Description | User Impact | Compliance |

|---|---|---|---|

| Strong Encryption | Using robust encryption protocols for data transmission and storage. | Increased confidence in the platform’s ability to protect their data. | GDPR, PCI DSS |

| Multi-factor Authentication | Requiring multiple forms of verification for account access. | Enhanced account security, reducing the risk of unauthorized access. | NIST guidelines |

| Regular Security Audits | Periodic assessments to identify and address vulnerabilities. | Improved assurance of the platform’s security posture, promoting user trust. | ISO 27001 |

| Data Minimization | Collecting and storing only the necessary data. | Reduced risk of misuse and improved transparency. | GDPR |

| Secure Payment Gateways | Using reputable and secure payment processors. | Confidence in the safety of financial transactions. | PCI DSS |

Marketing and Sales Strategies

Vehicle leasing platforms employ a multifaceted approach to attracting customers and converting leads. A strong marketing strategy is crucial for visibility and brand building in a competitive market. Effective sales strategies are equally important for converting prospects into satisfied clients. This section delves into the key strategies used by these platforms.

Marketing Strategies to Reach Target Audience

Vehicle leasing platforms utilize a diverse array of marketing channels to reach their target audience, including potential customers interested in short-term and long-term vehicle leasing options. These platforms understand that different segments respond to various marketing approaches, requiring tailored messaging and strategies.

- Digital Marketing: Platforms leverage online advertising (PPC, social media ads) to target specific demographics and interests. Search engine optimization () ensures high visibility in online searches for relevant s related to vehicle leasing.

- Content Marketing: Creating valuable content, such as blog posts, articles, and videos, about leasing benefits, vehicle comparisons, and industry trends attracts potential customers and establishes the platform as an authority.

- Partnerships and Collaborations: Collaborations with related businesses (dealerships, automotive associations, financial institutions) expand reach and provide access to new customer segments. This can involve co-marketing initiatives and joint promotions.

- Public Relations and Media Outreach: Press releases, media coverage, and participation in industry events raise brand awareness and build credibility.

- Referral Programs: Encouraging satisfied customers to refer new business through incentives builds trust and generates organic leads.

Sales Strategies for Lead Conversion

Successful sales strategies are designed to nurture leads and guide them through the leasing process, ultimately converting them into paying customers.

- Personalized Customer Interactions: Tailored communication based on individual customer needs and preferences is essential for building rapport and trust.

- Transparent Pricing and Lease Terms: Clear communication about pricing, lease terms, and associated costs fosters customer confidence and reduces concerns.

- Competitive Pricing Strategies: Offering competitive lease rates, tailored packages, and value-added services, such as maintenance or insurance options, can incentivize customers.

- Dedicated Account Management: Providing dedicated account managers to guide customers through the leasing process and address any concerns enhances the customer experience.

- Flexible Leasing Options: Providing a range of lease terms and vehicle options caters to diverse customer needs and preferences.

Comparison of Marketing Channels

Different marketing channels have varying degrees of reach, cost, and conversion rates. Understanding these factors allows platforms to optimize their marketing spend and maximize returns.

| Channel | Reach | Cost | Conversion Rate |

|---|---|---|---|

| Search Engine Optimization () | High | Low (long-term) | Moderate to High |

| Pay-Per-Click (PPC) Advertising | High | Variable (cost per click) | High |

| Social Media Marketing | High | Variable (depending on platform and targeting) | Moderate |

| Email Marketing | Targeted | Low | Moderate |

| Partnerships | High (potential) | Low to Moderate (depending on agreement) | High (potential) |

Examples of Successful Marketing Campaigns

Several vehicle leasing platforms have implemented successful campaigns focused on specific target audiences and goals. These campaigns often involve a combination of channels and strategies.

- Targeted Advertising Campaigns: Platforms have successfully targeted young professionals with lease offers for new cars.

- Content Marketing Initiatives: Creating informative articles and videos about the benefits of leasing can attract customers and build trust.

- Loyalty Programs: Offering rewards to repeat customers incentivizes continued business and generates positive word-of-mouth referrals.

Sustainability and Environmental Impact

Vehicle leasing platforms are increasingly recognizing the importance of environmental responsibility. The industry’s environmental footprint is substantial, and these platforms are actively seeking ways to mitigate their impact and promote sustainable practices. A key aspect of this is the shift towards more environmentally conscious vehicle choices and operations.The environmental impact of vehicle leasing is multifaceted, encompassing the entire lifecycle of a vehicle – from manufacturing to disposal.

This includes the emissions generated during operation, the resources consumed in production, and the potential for end-of-life management issues. By understanding and addressing these concerns, vehicle leasing platforms can play a crucial role in promoting a more sustainable transportation future.

Environmental Impact of Vehicle Leasing

The transportation sector contributes significantly to greenhouse gas emissions. Vehicle leasing, while offering benefits like reduced upfront costs and flexible ownership, can contribute to the problem if not managed sustainably. Manufacturing vehicles consumes significant resources, and the operational emissions throughout the vehicle’s lifespan, particularly during use, have a considerable environmental impact.

Vehicle leasing platforms are a great way to get a car without the hassle of ownership. They often offer competitive rates and flexible terms. Thinking about safety features, integrated radar for cars, like those found in radar for cars , can be a key consideration. Ultimately, leasing platforms provide a convenient and cost-effective alternative to traditional car ownership.

Vehicle Leasing Platforms’ Contribution to Sustainability

Vehicle leasing platforms can contribute significantly to sustainability efforts by prioritizing environmentally friendly vehicles, promoting electric vehicle adoption, and implementing efficient operational practices. For example, they can offer incentives for leasing electric vehicles, thereby encouraging the shift towards cleaner transportation. Furthermore, they can collaborate with manufacturers to ensure vehicles are produced with sustainable materials and recycled responsibly at the end of their lifespan.

Role of Electric Vehicles in Vehicle Leasing Platforms

Electric vehicles (EVs) are increasingly important in the vehicle leasing market. Platforms can play a crucial role in accelerating the transition to EVs by offering attractive leasing options for these vehicles, potentially including subsidies or incentives. This can incentivize customers to choose EVs, contributing to a reduction in carbon emissions. Furthermore, these platforms can also integrate charging infrastructure or partnerships with charging networks, enhancing the user experience and accessibility of EVs.

Examples of Environmentally Friendly Vehicle Leasing Practices

Several examples illustrate environmentally friendly vehicle leasing practices:

- Offering incentives for leasing electric vehicles (EVs), including potentially subsidized rates or tax benefits.

- Collaborating with manufacturers to prioritize sustainable materials and production processes for leased vehicles.

- Partnering with charging infrastructure providers to enhance the accessibility and convenience of EV charging for their customers.

- Implementing recycling programs for end-of-life vehicles to minimize environmental damage and maximize resource recovery.

Vehicle Leasing and Sustainability Table

This table highlights potential initiatives, impacts, and challenges associated with sustainability in vehicle leasing.

| Platform Initiative | Impact | Measurement | Challenges |

|---|---|---|---|

| Incentivizing EV leasing with subsidies | Increased EV adoption, reduced carbon emissions | Tracking EV leasing growth, comparing emissions data | Securing subsidies, competing with other EV incentives |

| Partnering with sustainable manufacturers | Reduced environmental impact throughout the vehicle lifecycle | Auditing manufacturing processes, evaluating material sustainability | Finding reliable and committed partners, verifying sustainability claims |

| Developing robust recycling programs | Minimizing waste, maximizing resource recovery | Tracking recycled materials, calculating waste reduction | Establishing effective recycling infrastructure, dealing with complex end-of-life processes |

| Integrating charging infrastructure | Improved EV accessibility and user experience | Tracking charging station usage, customer feedback | Implementing charging infrastructure across regions, maintaining charging network reliability |

Final Summary

In conclusion, vehicle leasing platforms are poised for continued growth, driven by evolving market demands and technological advancements. The platforms’ ability to simplify the leasing process, provide comprehensive options, and enhance the user experience will be key to their continued success. Understanding the various aspects discussed, from market trends to legal considerations, is crucial for both potential users and businesses looking to leverage these platforms effectively.

FAQ Corner

What are the different types of vehicle leasing options available?

Vehicle leasing platforms offer various options, including short-term, long-term, full-service, and other specialized leases tailored to specific needs and budgets. These options often vary in terms of terms, mileage allowances, and maintenance responsibilities.

How do I compare different vehicle leasing platforms?

Comparison tables are useful tools for assessing different platforms. Consider factors such as pricing models, leasing types, customer support channels, and available features. Reading reviews and checking reputation can also provide valuable insight.

What are the common security measures used by vehicle leasing platforms to protect user data?

Leading platforms use encryption and secure payment gateways to safeguard financial transactions and user information. They also employ robust authentication protocols and data privacy policies to ensure compliance with industry standards.

What is the role of data analytics in improving platform performance?

Data analytics allows platforms to understand user behavior, predict market trends, and optimize pricing strategies. It also helps in identifying areas for improvement in the user experience and in streamlining operations.