Autonomous vehicle insurance models sets the stage for a new era in the insurance industry. This complex field navigates evolving liability scenarios, from manufacturer responsibility to the role of the vehicle owner and operator. Understanding the nuances of these models is crucial to shaping the future of mobility.

Traditional insurance models struggle to adapt to the unique challenges presented by self-driving vehicles. This necessitates a deep dive into risk assessment methodologies, leveraging data analytics and cutting-edge technologies like machine learning. We will explore the key elements of these models, from coverage options and premium structures to legal and regulatory frameworks.

Existing Insurance Models for Traditional Vehicles

Traditional vehicle insurance models, largely based on liability, have evolved significantly over the years. These models often rely on historical accident data and driver profiles to assess risk and determine premiums. However, the advent of connected car technology and sophisticated data analytics is reshaping the landscape of insurance policies.Current insurance policies for conventional vehicles typically focus on protecting against financial losses arising from accidents.

The core principle is to provide financial compensation to victims of accidents, while also holding drivers accountable for their actions. However, these models are not without limitations, particularly in the face of autonomous vehicles.

Liability-Based Insurance Models

Liability-based insurance models are the cornerstone of traditional vehicle insurance. These models generally cover damages incurred by others in the event of an accident, but not necessarily the damages incurred by the insured vehicle or its occupants. The principle of fault is a key determinant in liability-based insurance. In most jurisdictions, the at-fault driver is responsible for covering damages to the other party involved in the accident.

This model has served as the foundation for insurance coverage for decades.

Key Components of Current Policies

The core components of current insurance policies for traditional vehicles encompass liability coverage, collision coverage, and comprehensive coverage. Liability coverage, as mentioned, protects against claims from others. Collision coverage covers damages to the insured vehicle regardless of fault, while comprehensive coverage extends to cover damages from events other than collisions, such as theft, vandalism, or natural disasters. Each coverage type has specific limitations and exclusions, defining the scope of protection offered.

Limitations of Traditional Policies

Traditional insurance policies face limitations in accurately assessing risk in the context of autonomous vehicles. Predicting accident probabilities for self-driving cars differs significantly from human-driven vehicles. The factors contributing to accidents are distinct, necessitating a shift in the risk assessment methodology. Additionally, establishing liability in the case of an autonomous vehicle accident can be complex, particularly when multiple parties are involved, including the manufacturer, the owner, and the vehicle’s software provider.

The complexity of these scenarios is a major challenge for traditional insurance models.

Evolution with Connected Car Technology

The rise of connected car technology has brought about a significant shift in how insurance companies assess risk. Data from vehicle sensors, including driving habits, location, and speed, are increasingly used to personalize insurance premiums. This data-driven approach allows insurers to identify high-risk drivers and tailor policies accordingly. For instance, telematics-based insurance programs reward safe driving habits with lower premiums.

However, the privacy and security of this data remain critical considerations.

Data Analytics in Risk Assessment

Data analytics plays a crucial role in assessing risk in traditional vehicle insurance. Sophisticated algorithms analyze vast amounts of data, including driving patterns, accident reports, and demographic information. This analysis enables insurers to identify patterns and trends, thereby improving their understanding of accident probabilities. For example, statistically significant correlations between driving habits and accident rates can help predict the likelihood of accidents for individual drivers.

The insights gained from data analytics allow insurers to refine their risk assessment models, potentially leading to more accurate premiums.

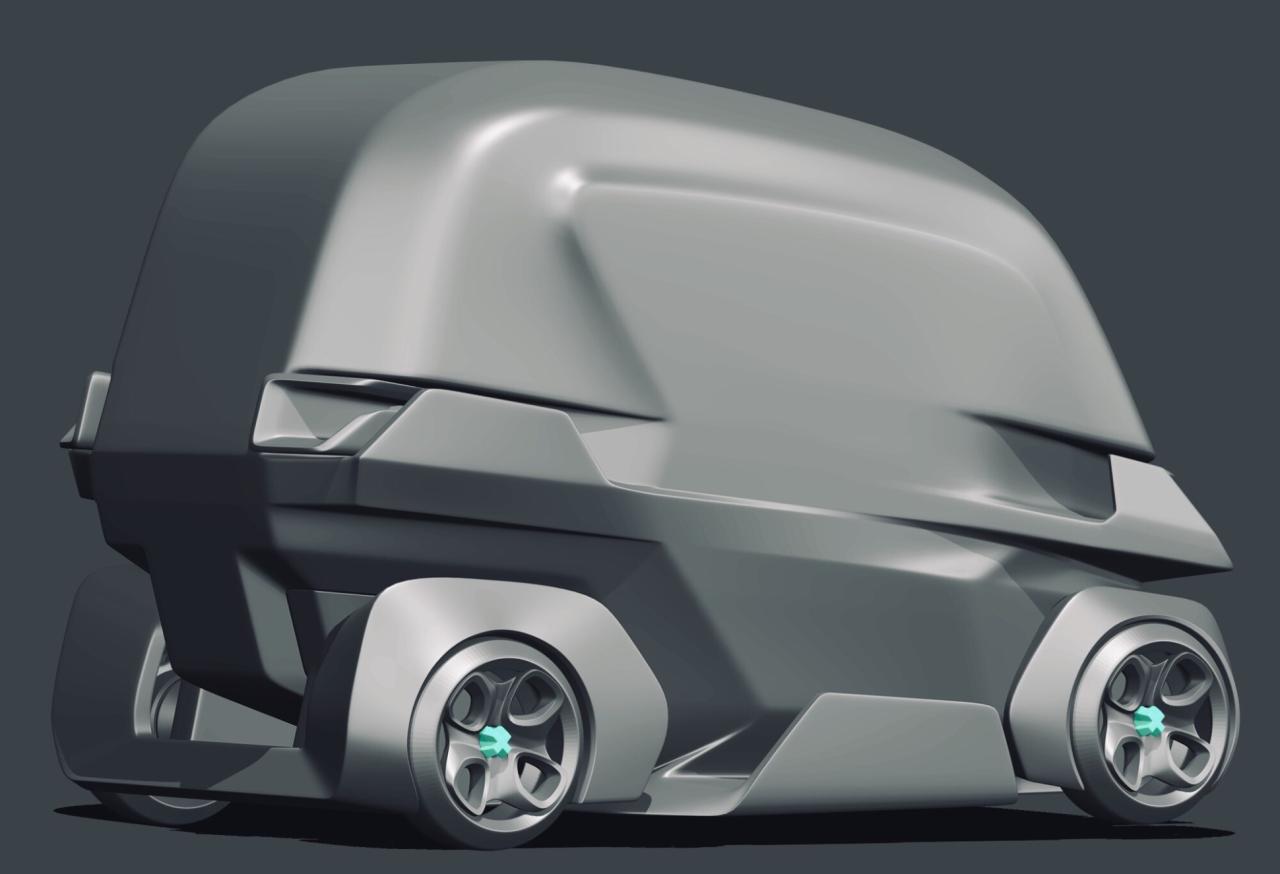

Insurance Models for Autonomous Vehicles

Autonomous vehicles present novel challenges for insurance models, necessitating a paradigm shift from traditional liability frameworks. The shift from human control to automated systems necessitates a careful consideration of liability and risk allocation. Existing insurance models for traditional vehicles are inadequate for handling the unique aspects of autonomous driving, including the complexities of determining fault in accidents.The complexity of autonomous vehicle technology mandates new insurance models that account for the potential for malfunction, unexpected events, and the interactions between autonomous vehicles and other road users.

These models must also consider the liability distribution amongst various stakeholders, including manufacturers, vehicle owners, and operators. This necessitates a more nuanced approach to risk assessment, potentially including factors like the level of autonomy, the vehicle’s software, and the driver’s role in the event.

Potential Insurance Models

Insurance models for autonomous vehicles must address the multifaceted nature of liability. Different models are being proposed, reflecting the evolving understanding of risks associated with autonomous driving. These models aim to provide appropriate compensation to victims while also incentivizing responsible autonomous vehicle development and operation.

Liability Assignment Scenarios

The assignment of liability in autonomous vehicle accidents is a crucial component of any insurance model. Several scenarios are possible, each with implications for insurance coverage. A table illustrating various potential liability assignments follows:

| Liability Assignment | Manufacturer | Vehicle Owner | Operator |

|---|---|---|---|

| Manufacturer Fault | Potentially liable for defects in the vehicle’s software or hardware. | Not typically liable unless owner knowingly used a defective vehicle. | Not typically liable, unless the operator is negligent. |

| Operator Fault | Not typically liable unless a defect in the system contributed to the accident. | Potentially liable if operator is a designated driver. | Liable if the operator is negligent, such as violating traffic laws. |

| Vehicle Fault (System Error) | Potentially liable for the vehicle’s system failure, depending on the cause. | Potentially liable if owner is aware of system failure and still used it. | Not typically liable unless the operator is negligent in handling the fault. |

Insurance Coverage Approaches

Various approaches to insurance coverage for autonomous vehicle accidents are being explored. A key consideration is the level of autonomy in the vehicle.

- Comprehensive Coverage: This model provides coverage for a wide range of incidents, including accidents resulting from system malfunctions, environmental factors, or human errors in the interaction with the autonomous system.

- Tiered Coverage: This approach stratifies coverage based on the level of autonomy, potentially offering higher premiums for vehicles with higher levels of automation. This recognizes the varying degrees of risk involved in different levels of autonomous operation. The premiums would be determined by the degree of autonomy, software capabilities, and safety features of the vehicle.

- Liability-Based Coverage: This model emphasizes fault determination in accidents, allocating coverage based on the party responsible for the incident. This might be a manufacturer, the vehicle owner, or the operator. The specific criteria for fault determination would need to be established to avoid ambiguity.

Shared Responsibility in Insurance

The concept of shared responsibility in autonomous vehicle insurance is vital. This model recognizes that accidents may involve multiple parties, each contributing to the event.

The sharing of responsibility in insurance for autonomous vehicles recognizes that accidents can involve multiple parties, each contributing to the outcome.

This shared responsibility necessitates a comprehensive approach to risk assessment and compensation. This concept might involve a proportional distribution of liability, taking into account the degree of negligence or contribution from each party involved in the accident.

Data and Technology in Autonomous Vehicle Insurance

Insurance companies are increasingly reliant on data and advanced technologies to evaluate risk and price policies for autonomous vehicles. This necessitates a shift from traditional models based on human driver behavior to ones that account for the unique characteristics of automated systems. Accurate risk assessment is crucial for establishing fair premiums and maintaining financial stability within the evolving insurance landscape.

Role of Data in Evaluating Autonomous Vehicle Risk

Data plays a pivotal role in evaluating the risk associated with autonomous vehicles. Comprehensive data collection encompasses various factors, including vehicle performance, environmental conditions, and the interactions between the vehicle and its surroundings. This detailed information is used to identify patterns and trends that can be used to predict future events and estimate the likelihood of accidents. Insurance companies can use this data to determine appropriate premiums, develop targeted safety measures, and create more accurate risk profiles.

Data Sources for Risk Assessment

A multitude of data sources contribute to the risk assessment process. These sources include sensor data from the vehicle itself, real-time traffic information, weather patterns, and historical accident records. Analyzing this diverse data allows for a more comprehensive understanding of the driving environment and potential risks.

- Vehicle Sensor Data: Autonomous vehicles are equipped with a range of sensors (cameras, radar, lidar) that provide continuous data on the vehicle’s surroundings, including other vehicles, pedestrians, and road conditions. This real-time feedback is essential for understanding the vehicle’s actions and identifying potential hazards.

- Traffic and Environmental Data: Real-time data on traffic flow, road conditions, weather, and other environmental factors are vital for accurate risk assessment. For example, high-density traffic zones or periods of heavy rain could increase the likelihood of accidents. Data from external sources like weather services and traffic monitoring systems are crucial inputs.

- Historical Accident Data: Historical accident data, including location, time of day, weather conditions, and vehicle types involved, provides valuable insights into potential risks. Analysis of past incidents can reveal patterns and trends in accident occurrences, helping predict potential areas of concern.

Sensor Data and AI for Predictive Modeling

Integrating sensor data with artificial intelligence (AI) techniques significantly enhances predictive modeling. AI algorithms can process the vast amount of sensor data to identify correlations and predict potential risks more accurately. This approach allows insurance companies to tailor premiums based on the specific driving conditions and vehicle performance.

- Predictive Modeling Enhancements: AI algorithms, particularly machine learning models, can identify complex relationships between various data points. These models can predict the probability of accidents based on real-time data, enabling more accurate risk assessment and personalized pricing. For example, a model might predict a higher risk of collision in heavy rain, allowing for an adjustment in the premium.

- Example: A machine learning model analyzing sensor data might identify a pattern where a specific autonomous vehicle system consistently reacts slower to certain road conditions, allowing insurers to assess and adjust the risk accordingly.

Machine Learning in Assessing Driverless Vehicle Behavior

Machine learning plays a crucial role in assessing the behavior of driverless vehicles. Sophisticated algorithms analyze sensor data to identify and categorize various driving maneuvers, allowing for a deeper understanding of vehicle performance. This enables insurance companies to assess the safety and reliability of different autonomous systems and tailor insurance policies accordingly.

- Autonomous Vehicle Behavior Analysis: Machine learning algorithms can identify anomalies in the driving behavior of autonomous vehicles. For example, a sudden deviation from the planned route or an unexpected reaction to a certain stimulus might be identified as a potential safety concern. This analysis allows for proactive identification of potential problems.

- Examples of ML Applications: Machine learning can assess the effectiveness of various safety features within autonomous vehicles, such as adaptive cruise control or lane-keeping assist. If a certain feature demonstrates consistent failure rates in specific conditions, insurance companies can use this data to adjust risk assessment and premium pricing.

Legal and Regulatory Frameworks

The burgeoning autonomous vehicle industry faces a critical juncture, requiring robust legal and regulatory frameworks to ensure safety, accountability, and public trust. These frameworks will underpin the viability and acceptance of self-driving technology, directly impacting insurance models and the broader adoption of these vehicles.Evolving legal and regulatory frameworks are essential for addressing the unique challenges posed by autonomous vehicles.

These frameworks must address liability, data security, and ethical considerations in a way that fosters innovation while mitigating risks. Navigating this complex landscape requires a global approach, considering diverse legal traditions and technological advancements.

Liability and Accountability

Current liability frameworks for traditional vehicles are often inadequate for autonomous vehicles. Determining liability in accidents involving self-driving cars requires careful consideration of the various actors involved, including the vehicle manufacturer, the software developer, and the user. Establishing clear lines of responsibility is paramount for effective insurance models and public acceptance.The concept of “proximate cause” in negligence lawsuits will likely play a significant role in determining liability in autonomous vehicle accidents.

The degree of human intervention at the time of the accident will influence the allocation of responsibility. For instance, if a human driver is present but the vehicle is operating autonomously, the determination of fault could be complex. Similar to determining responsibility in a case of a human-driven vehicle malfunction, the determination of liability will be challenging to interpret and implement.

Governmental Regulations

Governmental regulations play a critical role in shaping insurance models for autonomous vehicles. These regulations will influence the types of insurance products offered, the coverage limits, and the premiums charged. Insurance companies will likely adapt their policies and procedures to meet these regulatory mandates.Governments worldwide are actively developing regulations to address the unique safety and liability issues posed by autonomous vehicles.

The complexity of these vehicles necessitates careful consideration of different roles and actors in accidents involving autonomous vehicles, including manufacturers, software developers, and users. These regulations will impact the design, development, and deployment of autonomous vehicles.

Global Variations in Insurance Regulations

Significant variations exist in insurance regulations for autonomous vehicles across different countries and regions. These differences reflect varying legal traditions, technological maturity, and public policy priorities. Standardization is crucial to foster international trade and acceptance of autonomous vehicles.The regulatory landscape for autonomous vehicles varies significantly globally. For example, some countries might prioritize consumer protection, while others might focus on fostering innovation.

These differences create challenges for insurers, requiring a nuanced approach to pricing and coverage. Furthermore, these variations require a global framework to ensure consistent standards and promote global acceptance of autonomous vehicles. Differences in regulations across the globe create challenges in ensuring consistent standards and promoting global adoption of autonomous vehicles.

Coverage and Premiums for Autonomous Vehicles

Autonomous vehicle insurance presents unique challenges and opportunities for insurers. Traditional models struggle to adapt to the complexities introduced by automated driving systems. New approaches to premium structures and coverage are essential to fairly compensate for the changing risk landscape.The evolving nature of risk associated with autonomous vehicles necessitates a nuanced understanding of how these systems operate and the potential for various accident scenarios.

This understanding underpins the development of suitable insurance policies and premium structures. Precise assessment of liability, both for the vehicle’s automated systems and the human operator, is critical for the design of appropriate coverage.

Autonomous vehicle insurance models are a hot topic, considering the unique challenges they present. Innovations like active noise cancellation cars, like these , are subtly changing the way we think about safety and comfort in vehicles, which, in turn, will likely affect how insurance is priced and structured for autonomous vehicles in the future.

Potential Premium Structures

Insurance premiums for autonomous vehicles are likely to differ significantly from those for traditional vehicles. Factors such as the level of automation, vehicle usage patterns, and driver behavior will significantly influence premium calculations. The potential for accident prevention technologies, such as advanced driver-assistance systems (ADAS), will also play a critical role in determining premiums.

Methods for Calculating Premiums

Several approaches can be employed to calculate premiums for autonomous vehicles. A data-driven approach, leveraging detailed driving data collected from autonomous vehicles, can provide valuable insights into usage patterns and risk factors. Statistical models can analyze this data to estimate the likelihood of accidents, thus influencing premium calculations. Furthermore, the level of automation and the presence of safety features will significantly impact the risk profile of the vehicle, thereby affecting the premium.

Impact of Usage Patterns

Usage patterns play a pivotal role in determining insurance premiums. Frequent use, particularly in high-risk environments (e.g., congested urban areas or inclement weather conditions), will likely result in higher premiums. Conversely, vehicles used primarily in low-risk environments, such as rural routes, may have lower premiums. The hours of operation and the frequency of use can be considered in premium determination.

Types of Coverage

Understanding the types of coverage offered for autonomous vehicles is crucial for both policyholders and insurers. The table below Artikels potential coverage types, along with a brief description of each.

| Coverage Type | Description |

|---|---|

| Comprehensive | Covers damages to the vehicle regardless of who is at fault, including damage from accidents, natural disasters, or vandalism. |

| Liability | Covers damages to other people or their property if the vehicle is at fault in an accident. This is essential as autonomous vehicles may be involved in accidents where fault determination is complex. |

| Uninsured/Underinsured Motorist | Covers damages to the vehicle or its occupants if the at-fault party does not have sufficient insurance coverage. |

| Collision | Covers damage to the vehicle in an accident, regardless of fault. Crucial for the protection of the autonomous vehicle itself. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for the vehicle’s occupants if injured in an accident. |

Insurance for Different Autonomous Vehicle Levels

Insurance coverage for autonomous vehicles necessitates a nuanced approach, varying significantly based on the level of automation. The degree of vehicle automation directly influences the extent of human intervention and, consequently, the apportionment of responsibility in the event of an accident. This necessitates a careful evaluation of the varying degrees of automation to accurately determine liability and tailor appropriate insurance policies.

Differing Levels of Autonomy

Autonomous vehicles operate across a spectrum of automation levels, each impacting the responsibility and coverage within insurance models. Level 0 vehicles have no automation, placing full responsibility on the human driver. As automation increases, the responsibility shifts, potentially requiring a re-evaluation of the insurance model.

Impact on Insurance Coverage

Insurance models for autonomous vehicles must reflect the evolving levels of automation. For instance, a Level 2 vehicle, which allows for automated features like lane keeping or adaptive cruise control, still mandates significant human input. Insurance policies for these vehicles might involve a combination of liability coverage and potentially a reduced premium compared to fully autonomous vehicles.

Examples of Insurance Model Variations

Insurance premiums for Level 3 vehicles, capable of performing driving tasks under certain conditions, may see a more substantial shift. The responsibility for certain actions might be shared between the vehicle and the driver. For Level 4 vehicles, which handle most driving tasks, insurance premiums could be adjusted to account for the vehicle’s advanced capabilities and the limited human intervention required.

Evolving Responsibility in Insurance

As autonomy levels increase, the responsibility for accidents becomes progressively more complex. The apportionment of liability is crucial in determining insurance coverage and premiums. Legal frameworks must adapt to ensure fair compensation for damages and accountability in accidents involving increasingly automated vehicles. The evolving responsibility in insurance necessitates ongoing dialogue and collaboration between stakeholders, including manufacturers, insurance companies, and legal experts.

Table Comparing Coverage Options

| Autonomous Vehicle Level | Description | Primary Responsibility | Potential Coverage Variations |

|---|---|---|---|

| Level 0 (No Automation) | Fully human-operated vehicle. | Driver | Standard liability insurance. |

| Level 1 (Driver Assistance) | Limited automated features. | Driver, with some support from the vehicle. | Potential discounts or premiums based on vehicle features and driver usage patterns. |

| Level 2 (Partial Automation) | Vehicle assists with driving tasks. | Shared responsibility between driver and vehicle. | Reduced premiums compared to Level 0, but still high driver involvement. |

| Level 3 (Conditional Automation) | Vehicle can take over driving tasks in specific situations. | Shared responsibility, potentially with a transition period. | Premiums reflecting the increased automation, potential for a new “conditional” liability model. |

| Level 4 (High Automation) | Vehicle handles most driving tasks, human intervention required only in specific situations. | Vehicle, with limited human intervention. | Higher premium adjustments, potentially more coverage based on vehicle-specific safety features. |

| Level 5 (Full Automation) | Vehicle operates without human intervention. | Vehicle | Significant premium adjustments, specialized insurance products, potentially new liability structures. |

Consumer Perception and Adoption

Consumer acceptance of autonomous vehicles (AVs) hinges significantly on their perceived safety and reliability. A robust and transparent insurance model plays a crucial role in shaping this perception, influencing consumer confidence and ultimately driving adoption rates. Addressing potential anxieties surrounding liability and financial responsibility is paramount.Consumer trust in AV insurance models is contingent upon several factors. These factors range from perceived fairness of pricing to the clarity and comprehensiveness of coverage.

The transparency and comprehensiveness of insurance policies will directly influence the level of consumer confidence.

Factors Influencing Consumer Trust

Consumer trust in AV insurance models is influenced by a multitude of factors. These factors are intricately linked to the perceived fairness and efficacy of the insurance system.

- Transparency and Clarity of Coverage: Consumers need clear and concise explanations of coverage, exclusions, and liability limits. Vague or overly complex policies will breed distrust. Clear language and easily accessible information, ideally through various digital channels, are essential.

- Fairness and Affordability of Premiums: Premiums must be justified by the risks associated with different autonomous vehicle levels. Premiums should be transparent and demonstrably linked to risk assessments, avoiding perceived unfairness. Consumers will be more likely to trust insurance if they perceive that premiums are calculated fairly.

- Claim Settlement Processes: A smooth and efficient claim settlement process is vital. Delayed or problematic claims can severely erode consumer trust. Prompt, transparent, and fair resolutions are critical to maintaining public confidence.

- Public Awareness Campaigns: Educating the public about the benefits and limitations of AVs, as well as the insurance mechanisms surrounding them, is vital. Informative campaigns emphasizing safety and accountability can foster public understanding and acceptance.

Promoting Public Acceptance

Effective insurance models can actively promote public acceptance of AVs by addressing public concerns and fostering trust.

- Demonstrating Safety and Reliability: Insurance models should demonstrate a commitment to safety and reliability through partnerships with research institutions, accident data analysis, and proactive risk management strategies. Transparency and open communication about these measures will build consumer trust.

- Clear Communication and Education: Insurance companies should actively participate in public education campaigns that explain how insurance works in the context of AVs. This will help consumers understand their rights and responsibilities in case of accidents involving autonomous vehicles. Simplified explanations and diverse media outlets should be used.

- Collaboration and Partnerships: Insurance companies can collaborate with AV manufacturers, technology providers, and regulatory bodies to ensure that insurance models are responsive to the evolving landscape of AV technology. This collaborative approach will build trust in the safety and security of the entire ecosystem.

Insurance’s Role in Future Mobility

Insurance is not just a financial product; it’s a critical component in shaping the future of mobility.

- Encouraging Innovation: Insurance models can provide the financial framework for innovation in autonomous vehicle technology, thereby supporting the development of safer and more efficient systems. Insurers can collaborate with innovators to establish a framework for supporting future development.

- Promoting Adoption and Investment: Insurance plays a key role in encouraging consumer adoption and investment in AV technology. By mitigating risk and offering tailored coverage, insurance can encourage the wider adoption of these technologies. This fosters a sense of confidence in the future of autonomous driving.

- Facilitating Infrastructure Development: Insurance companies can play a role in financing and facilitating the necessary infrastructure for AVs. This can include investments in charging stations, repair facilities, and support networks, encouraging the broader adoption of autonomous vehicles. It also ensures that the insurance system can adapt to the needs of this evolving transportation model.

Cybersecurity in Autonomous Vehicle Insurance

Autonomous vehicles, while promising a safer and more efficient future of transportation, introduce novel cybersecurity risks. These risks significantly impact the insurance industry, necessitating a robust understanding and proactive approach to ensure equitable and sustainable coverage. The vulnerability of these vehicles to cyberattacks necessitates a shift in traditional insurance models, demanding a focus on protecting both the vehicle and its occupants.Cybersecurity vulnerabilities in autonomous vehicle systems pose a substantial threat to the stability and integrity of the insurance industry.

Exploiting these vulnerabilities could lead to substantial financial losses for insurers and potentially severe consequences for drivers and passengers. This underscores the critical need for preventative measures and comprehensive risk assessments.

Impact of Vulnerabilities on Insurance

Autonomous vehicle systems are intricate networks of interconnected components, making them susceptible to various cyberattacks. Compromised systems can lead to malfunctions, such as unintended acceleration, braking, or steering, resulting in accidents. Furthermore, attackers could potentially manipulate data from the vehicle’s sensors, leading to misinterpretations of the surrounding environment and dangerous maneuvers. Such vulnerabilities directly impact insurance claims, increasing the frequency and severity of accidents and potentially invalidating pre-existing coverage.

Potential Risks Associated with Hacking and Malicious Attacks

The potential for malicious attacks on autonomous vehicles spans a wide range of scenarios. Hackers could manipulate the vehicle’s software, leading to uncontrolled actions and accidents. Data breaches involving the vehicle’s onboard systems, including sensor data and driver information, could have serious implications for privacy and insurance. Moreover, attacks on the vehicle’s communication networks could allow hackers to intercept and manipulate commands, leading to hazardous situations.

Importance of Robust Cybersecurity Measures

Robust cybersecurity measures are crucial for mitigating the risks associated with autonomous vehicle attacks. Implementing strong encryption, intrusion detection systems, and secure communication protocols are vital steps. Continuous monitoring and updates to software and hardware are essential to address vulnerabilities as they emerge. Regular security audits and penetration testing can identify potential weaknesses and help strengthen the overall system.

The industry needs to collaborate and share best practices to ensure that cybersecurity is integrated into every stage of autonomous vehicle development and deployment. Insurance companies must work closely with vehicle manufacturers to develop comprehensive cybersecurity protocols and integrate them into the design and operation of autonomous vehicles. This collaborative approach will be vital in creating a safer and more secure environment for autonomous vehicle users.

Future Trends and Innovations: Autonomous Vehicle Insurance Models

The autonomous vehicle (AV) insurance landscape is poised for significant transformation. As AV technology advances, insurance providers must adapt to new risk factors and develop innovative solutions to ensure coverage and affordability. This adaptation necessitates a forward-thinking approach to risk assessment, pricing, and technological integration.The increasing sophistication of AV systems necessitates a paradigm shift in insurance models. Existing models, designed for human-driven vehicles, are inadequate for the complexities inherent in autonomous operation.

This necessitates a deeper understanding of the unique challenges and opportunities presented by this emerging technology.

Anticipated Future Developments in Autonomous Vehicle Insurance Models

Insurance models for autonomous vehicles will likely incorporate more sophisticated risk assessment methods. These methods will be tailored to the specific level of autonomy, the vehicle’s performance data, and the driver’s behavior (if present). For example, vehicles with higher levels of autonomy might see lower premiums if their performance data consistently demonstrates safety and reliability. Conversely, vehicles with lower levels of autonomy might have higher premiums to reflect the increased risk of human error.

Potential Innovations in Risk Assessment and Pricing Strategies

Risk assessment will become more nuanced and data-driven. Insurers will leverage real-time data from the vehicle’s sensors, communication networks, and cloud-based platforms. This data will allow for more accurate estimations of accident risk, facilitating personalized pricing models.

Examples of Emerging Technologies Shaping the Future of Autonomous Vehicle Insurance

Several technologies hold significant potential for transforming autonomous vehicle insurance:

- Predictive Modeling: Sophisticated algorithms will analyze vast datasets of driving behavior, environmental conditions, and vehicle performance to predict potential accidents. This proactive approach will enable insurers to adjust premiums and offer tailored coverage packages in advance, reducing the likelihood of unexpected events.

- Telematics and Sensor Data Integration: Real-time data from the vehicle’s sensors will enable insurers to monitor driving performance, identify risky behaviors, and adjust premiums dynamically. This approach enhances accuracy and responsiveness, adjusting premiums in real-time based on driving conditions and performance.

- Machine Learning: Machine learning algorithms will analyze massive datasets to identify patterns and correlations between various factors (e.g., weather conditions, time of day) and accident risk. This will allow for the development of more accurate and effective risk assessment models.

How the Insurance Industry Can Adapt to the Changing Needs of the Autonomous Vehicle Market, Autonomous vehicle insurance models

The insurance industry must embrace a culture of continuous learning and adaptation to the rapidly evolving AV landscape. This includes investing in:

- Data Analytics Expertise: Insurance companies will need skilled data analysts and engineers to process and interpret the vast amount of data generated by autonomous vehicles. This will help to understand the nuances of the data and to accurately predict future risks.

- Technological Infrastructure: Investing in advanced data storage, processing, and communication infrastructure is crucial for handling the large volumes of data generated by AVs.

- Collaboration and Partnerships: Collaboration with AV manufacturers, technology companies, and regulatory bodies will be essential to develop effective insurance solutions.

Case Studies and Examples

The development of robust insurance models for autonomous vehicles necessitates the analysis of successful implementations and lessons learned from challenges encountered. This section explores real-world case studies and examples to illustrate diverse approaches to insurance claim handling and comparative models employed by leading companies in the autonomous vehicle sector.Case studies offer valuable insights into the practical application of theoretical frameworks and help to identify areas requiring further refinement.

Analyzing past experiences can guide future strategies and highlight the crucial aspects of successful insurance design in this rapidly evolving technology sector.

Successful Insurance Models

Early adopters of autonomous vehicle technology have been exploring various insurance models, some of which have shown promise. Companies like Waymo have focused on extensive data collection and risk assessment to develop models that consider vehicle performance, driver behavior, and environmental factors. These sophisticated models can potentially lead to more precise risk stratification and, consequently, tailored premiums. A notable example is the development of pay-as-you-go insurance models that are dynamically adjusted based on real-time driving data.

Challenges and Lessons Learned

Implementing autonomous vehicle insurance models has presented unique challenges. One prominent hurdle is the need for extensive data collection and analysis. Accurately evaluating the risk associated with autonomous vehicles requires vast amounts of data from various sources, including sensor data, driving patterns, and environmental conditions. Furthermore, establishing clear liability frameworks for accidents involving autonomous vehicles has been a significant challenge.

Autonomous vehicle insurance models are a complex issue, needing innovative solutions. The integration of AI-powered dash cam technology, like AI-powered dash cam , could significantly impact how these models are designed. This technology promises to provide clearer data on accident causation, ultimately leading to more accurate and fairer insurance premiums for autonomous vehicles.

Jurisdictional differences in legal frameworks have complicated the process, necessitating a standardized approach across various regions. Lessons learned include the importance of collaboration between insurance companies, technology providers, and regulatory bodies to address these challenges effectively.

Insurance Claim Handling

Autonomous vehicle accidents may involve unique complexities requiring innovative claim handling procedures. A crucial element is the integration of sensor data and vehicle diagnostics to accurately determine the cause of an accident. This data can be instrumental in determining liability and facilitating a fair resolution for all parties involved. For example, advanced analytics can be used to assess the impact of environmental factors like weather conditions on vehicle performance.

The use of detailed incident reports, supplemented by automated data analysis, is likely to become increasingly important.

Comparative Analysis of Leading Companies

A comparison of insurance models adopted by leading companies in the autonomous vehicle sector reveals diverse approaches. Some companies focus on pay-as-you-go models, dynamically adjusting premiums based on real-time driving data. Others adopt a tiered approach, differentiating premiums based on the level of autonomy offered by the vehicle. Table 1 below provides a comparative overview.

| Company | Insurance Model | Key Features |

|---|---|---|

| Waymo | Data-driven, pay-as-you-go | Dynamic premium adjustments based on real-time vehicle performance and driver behavior |

| Cruise | Tiered approach | Differentiated premiums based on vehicle autonomy level |

| Tesla | Integration of existing models with AI-driven analysis | Leveraging existing data infrastructure and employing AI to identify risk patterns |

Last Word

In conclusion, autonomous vehicle insurance models represent a significant shift in the insurance landscape. This evolution necessitates a multifaceted approach, encompassing data-driven risk assessment, innovative coverage options, and adaptability to the evolving legal and regulatory frameworks. The future of autonomous vehicles hinges on the success of these models, influencing consumer adoption and ultimately shaping the future of transportation.

FAQ Guide

What are the key stakeholders involved in the autonomous vehicle insurance market?

Key stakeholders include manufacturers, vehicle owners, operators, insurance companies, and regulatory bodies.

How does data analytics impact risk assessment in traditional vehicle insurance?

Data analytics helps assess risk by analyzing driving patterns, accident history, and vehicle performance data.

What are the potential legal challenges related to liability in autonomous vehicle accidents?

Legal challenges include determining liability in accidents where human intervention is minimal or absent. This often leads to questions about shared responsibility.

How will cybersecurity vulnerabilities affect autonomous vehicle insurance?

Cybersecurity vulnerabilities, such as hacking, can significantly impact insurance, potentially leading to higher premiums or even policy exclusions.

What are the expected future trends in autonomous vehicle insurance models?

Future trends may include the use of AI-powered risk assessment, personalized premium pricing based on usage patterns, and increased reliance on sensor data.